Business moves fast and consumers have clear expectations about how they want to pay. Credit cards are the primary payment method for 33 to 37% of consumers according to a study by Bankrate. In B2B transactions, credit card usage continues to rise as companies look for faster payment options and opportunities to leverage credit card incentives and promotions.

With rising concerns regarding data breaches and payment fraud, it’s imperative to ensure that your business is protected when accepting credit card payments. Storing credit card data in your internal systems, whether that be directly in your ERP or on a spreadsheet, is risky and can prove to be extremely costly if a security breach were to occur.

Protect Credit Card Data with Tokenization

In order to protect credit card data while still allowing payments, iSolutions uses tokenization for all credit card payments made. Tokenization replaces a customer’s actual credit card number with a secure token that looks like random data and is useless on its own.

That means that Dynamics 365 Business Central only ever sees and stores the token and never the actual card number. This ensures your company is protected if a data breach ever occurs.

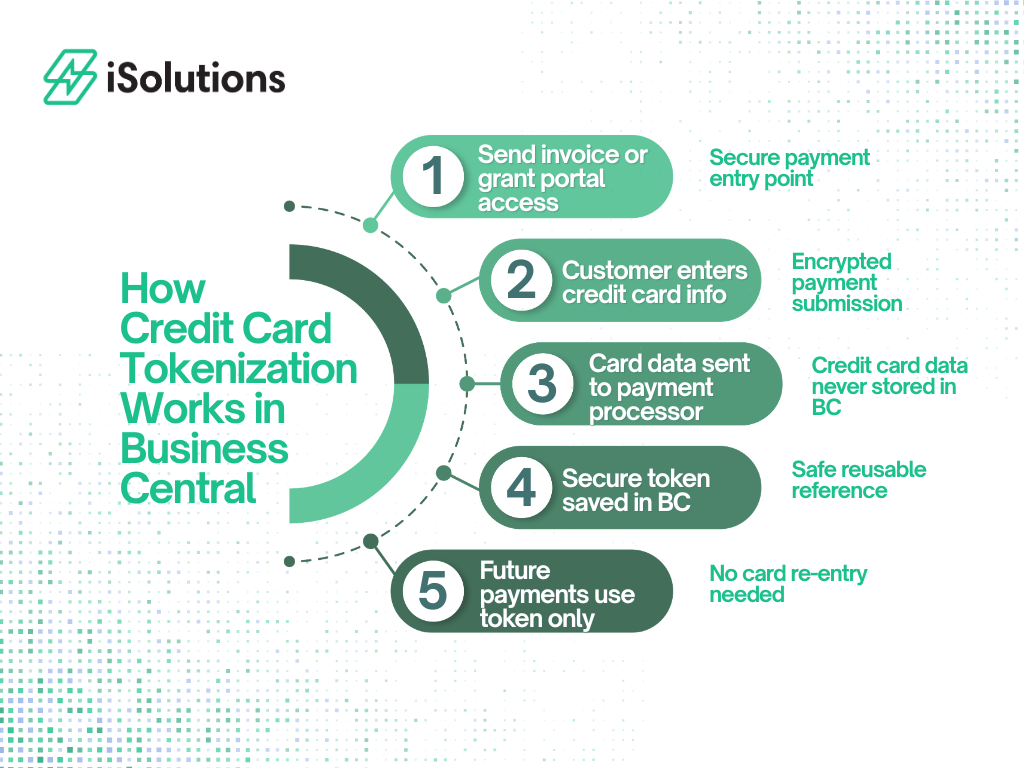

How Tokenization Actually Works

- You invoice your customer with a click to pay link from iPayments or provide direct access for your customer to view their account information within the Customer Portal.

- The customer enters their credit card information and makes the payment.

- The card data goes directly to the payment processor and never actually reaches your Business Central database.

- A secure token is returned and saved on the customer’s account in Business Central, allowing the card to be reused safely. Customers can also save their payment method themselves through the Customer Portal.

- All future payments, retries, and refunds use the token, not the actual credit card number, so there’s no need to re-enter card details.

Tokenization Means Security and Compliance

By using tokenization to save sensitive credit card information, your organization dramatically reduces PCI scope and breach risk. Even if your data within Dynamics 365 Business Central was exposed, or if sensitive information was accessed by an internal employee, the only information that would be available is the token and not any credit card information.

Tokenization vs. Encryption

Both tokenization and encryption are used to protect data but they work differently.

Encryption scrambles sensitive data using an algorithm and a key. The original credit card number still exists, but in an unreadable format. If a hacker taps into both the encrypted data and the decryption key, they can access credit card information, making the breach impact substantial. Encryption is not a preferred method for protecting credit card information and is more frequently used for data or file transfers.

Tokenization replaces the real credit card number with a placeholder, only storing the real credit card number is a secure vault owned by the payment processor. Even if your data in Business Central is breached, no credit card information would be available as the tokens are meaningless. This is the best process for accepting credit cards securely.

Benefits of tokenization for Dynamics 365 Business Central users

- Faster, safer recurring payments

Once your customers provide their credit card information, a token is generated and stored within Dynamics 365 Business Central. You can use that token to process recurring billing, subscriptions, payment retries, or any other recurring payments. The customer never has to input their credit card information again, meaning a faster checkout process.

- Improved customer experience

With a secure payment system like iPayments for Dynamics 365 Business Central, your customers can rest assured their payment information is secure. On top of that, the ability to make payments is easy. They simply click a provided payment link to access their invoice, enter their credit card information, and complete the payment. Their payment token is associated to their account so they can use the same payment method for each invoice.

- Reduced compliance burden and cost

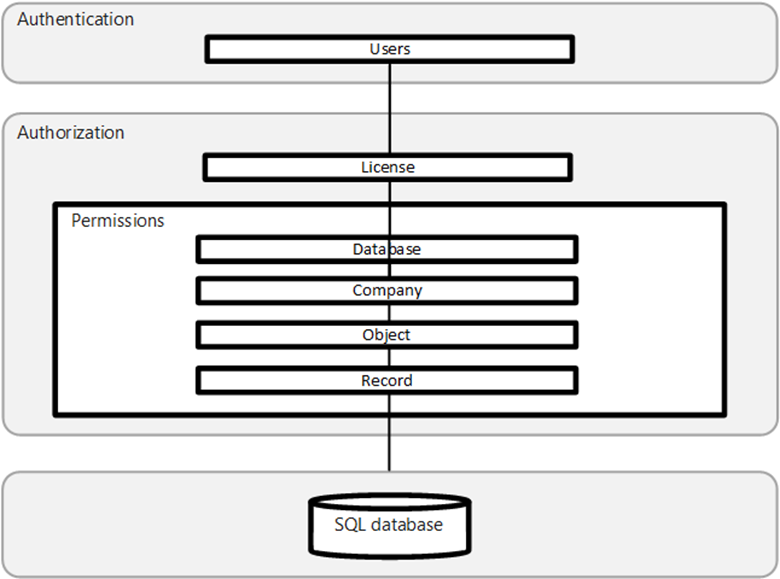

Data security is critical to today’s businesses and the cost to ensure your systems are protected is on the rise. With Dynamics 365 Business Central and iPayments, your data is protected. Business Central uses a layered approach to application security.

Data security in Business Central

Before users can sign in to Business Central, they must be authenticated as a valid user in the system. Once authenticated, authorization determines which areas the user can access. The Business Central security system allows you to control which objects or tables a user can access within each database. You can specify the type of access that each user has to these objects and tables, whether they’re able to read, modify, or enter data.

iPayments integrates directly with Business Central, allowing you to accept credit card payments for invoices or sales orders created. Using tokenization, all payments processed through iPayments are secure.

Tokenization Is the Foundation of Secure Payments in Business Central

Accepting credit card payments in Dynamics 365 Business Central should never require tradeoffs between convenience, security, and compliance. Tokenization makes it possible to deliver all three.

By ensuring that raw credit card numbers never touch your Business Central database, tokenization protects your business from unnecessary risk while enabling faster payments, automated billing, and a better experience for your customers. It reduces PCI scope, limits breach exposure, and supports modern AR workflows – all without adding complexity for your team.

When evaluating payment and AR solutions for Dynamics 365 Business Central, tokenization should be considered a baseline requirement, not a differentiator. Any solution that stores or exposes credit card data inside your ERP puts both your organization and your customers at risk.

iPayments for Dynamics 365 Business Central uses tokenization for all credit card transactions, allowing you to securely accept payments, support recurring and stored payment methods, and manage receivables directly inside Business Central all without ever storing sensitive card data.

If you’re looking to modernize how you accept payments while keeping security at the core, tokenization is essential.

If you’re ready to start taking secure credit card payments in Dynamics 365 Business Central, reach out to the iSolutions team.