With the sunsetting of Dynamics GP approaching, companies still relying on GP are looking for their next ERP solution. Staying on GP isn’t an option due to enhanced security risks, increased exposure to cyberattacks and data breaches, compliance issues and a host of other challenges that will arise after Microsoft no longer supports the product. This is leaving companies searching for their next – and hopefully last – ERP solution.

As of 2024, over 15,000 businesses have implemented Dynamics 365 Business Central, with a reported user increase of 200% annually. Those businesses moved from other ERP solutions – including Dynamics GP – to take advantage of a cloud based, modern solution with growing features and functionality, benefiting small companies all the way to those classified as emerging enterprise.

Companies moving from Dynamics GP have many business processes to evaluate when moving to Business Central, but none more important than Accounts Receivable.

Top Four Key Differences and Similarities Between Accounts Receivable in Dynamics GP and Dynamics 365 Business Central

- Invoice creation

Same: Dynamics GP and Dynamics 365 Business Central allow creating and posting AR invoices and credit memos.

Different: BC supports recurring sales invoices and templates. With iPayments add-on you can also add Click to Pay links for faster, immediate payments.

- Customer Statements

Same: Both can generate and send customer statements

Different: BC offers automated scheduling and emailing of statements; GP is manual unless using add-ons. With iPayments you can not only include Click to Pay links, but provide a customer portal where your customers have self service access to their invoice history, shipment information, open invoices, and can also make payments.

- Collections and Reminders

Same: Both track outstanding balances and aging.

Different: BC has built-in automated reminders with multiple levels; GP needs Collections Management add-on for similar functionality. Advanced Collections, included with iPayments, adds advanced features for collections including collections plans, collections reminders, configurable AR aging buckets, assign/transfer collectors, and more.

- Payment Application

Same: Both allow applying payments to invoices manually or during posting.

Different: BC supports auto-apply and payment tolerance rules; GP is mostly manual apply. iPayments allows you to digitally accept credit card and ACH payments that are automatically applied to the account in real-time with no manual process required.

Let’s dive deeper into the core features and functionality for Accounts Receivable when comparing Dynamics GP to Dynamics 365 Business Central – with and without the iPayments add-on.

Accepting Payments |

|||

| Dynamics GP | Dynamics 365 Business Central | iPayments Add-On for Business Central | |

| Credit Card Payments

|

Cannot accept credit card payments out of the box | Cannot accept credit card payments out of the box | Integrates directly with Business Central to allow you to accept all forms of credit card payments and automatically applies the payment to the invoice in BC.

|

| Credit Card Reconciliation | Not available out of the box | Not available out of the box | Upon receipt of credit card payment, invoices and account information within Business Central are automatically updated to reflect payment.

|

| Payment Entry | Record payment details manually including payment number, date, vendor ID, payment method (check, cash, credit card, etc), checkbook ID, amount

GP allows direct manual checks with account distribution

|

Record payment details manually including posting date, document type, account type, account number, amount

Business Central requires a purchase invoice or payment journal. Offers suggested vendor payments, apply entries, and EFT/check printing options

|

Automatically applies credit card payments or ACH payments made via Click to Pay link on invoices, requiring no manual entry. |

| Approvals for Payments or Journals | Workflow for receivables batch approvals. Ability to auto-post receivables batches once approved. | Approval Workflows for general/payment journals (lock while pending, amount based routing); templates and user amount limits supported.

|

Once a payment is approved in BC, iPayments can process it electronically and post it automatically, reducing manual steps after approval. |

| ACH /Credit Card | ACH by manual entry. No credit card options. | ACH by manual entry. No credit card options.

|

Accept ACH/eCheck payments directly from invoices and statements, add Click to Pay links, and offer a customer portal—with real-time posting to A/R and the G/L.

|

| Bank Reconciliation | Bank reconciliation is a mostly manual process where you enter statement balances and match transactions without built-in bank feeds or auto-matching. | Bank reconciliation is streamlined with auto-matching, bank statement imports, and optional bank feed integration for greater automation. | Reduces manual matching work by ensuring more transactions are already posted and applied before the bank statement import.

|

| Funding | Grant Management and Fund Accounting available out of the box.

Ability to track multiple funding sources, interfund accounting, encumbrance management, budget and compliance controls, grant lifecycle management |

No Grant module. BC uses dimensions, projects (jobs) and financial posting groups to simulate fund accounting.

Standard BC supports budgets by G/L account and dimension; add-ons enhance this for fund restrictions.

|

iPayments funding job will automatically record a debit to the bank and a credit to the clearing account when a deposit is made. |

Collections Management |

|||

| Dynamics GP | Dynamics 365 Business Central | iPayments Add-On for Business Central | |

| Aged Receivables | Standard Aged Trial Balance reports | Built in Aged AR with drill down and filters | Adds real-time payment updates from online transactions

Configurable AR Aging Buckets – Age by due date, posting date, or document date. Define quantity and length of periods. This setting produces your collection manager aged accounts receivable.

|

| Customer Statements | Manual print/email | Automated statements with scheduling and email integration | Add on Click to Pay links for faster collections |

| Collection Notes | Requires Collection Management add-on | Basic comments on customer ledger entries | Create notes on communication with customers such as calls or emails. |

| Automated Reminders + Collection Plans | Not native, needs add-on | Reminder terms with multiple levels and auto-email | Automatically email invoices upon posting, when a credit memo is posted, and include note no. series.

Send customers automated reminders for past due invoices with click to pay links.

Option to include attachments and select from a variety of templates including collector and delinquent alerts.

Automated plan sequence for balance due, delinquency notices, or collections which halts automatically upon payment received.

Can include reminders and past due .

Ability to have different plan types for different customers.

Reminders can be tailored to your preferences – including reminders when a payment due date is approaching or when a payment is past due. Open invoices can be sent individually or combined into one reminder email.

|

| Dispute Management | Manual notes on the account | Basic blocking/comments | |

| Payment Links | Not native, needs add-on | Not native, needs add-on | Integrated credit card, ACH, and recurring billing within Business Central. |

| Customer Portal | Not native, needs add-on | Not native, needs add-on | Customer portal where customers can view invoices, orders, shipping, history, and make payments.

|

Collections Manager within the iPayments App for Business Central

Real-Time Customer Portal from iSolutions

National Accounts |

|||

| Dynamics GP | Dynamics 365 Business Central | National Accounts add-on for Dynamics 365 BC from iSolutions** | |

| Link Parent Account to Multiple Child Customers | Out of the box | Not available, can route AR to a parent by using bill to customer or sell to customer. All manual. | Adds parent/child functionality to Business Central similar to what is available in Dynamics GP |

| Cash application and invoice payment | Parent can apply receipts or payments to child invoices

Allow centralized cash receipt management for all customers of the parent account

|

Only manually apply through bill-to feature | Apply payments received from the parent to invoices of any child in the group

Choose features to activate per national account – including allowing cash receipt entry for children or defaulting to the parent data

Allow centralized cash receipt management for all customers of the parent account

|

| Refunds to child through parent | Not able to refund a child customer using parent information. Refunds tied to customer ID. | Not available | Refund child customers using the parent customer information

|

| View entire financial picture of parent and children | Provides consolidated aging and statement options at the parent level, so you can see the full outstanding balance across all linked customers.

|

Not available | View information for the entire national account including transaction history and balances by child or in total

|

**National Accounts App currently available for early access registration. Contact us today and let us know you’re interested – you’ll be the first to get notified when it’s available

Business Central provides additional functionality for Accounts Receivable compared to Dynamics GP, especially when it comes to eliminating manual processes, but it still is lacking in many areas that will help you accelerate collecting payments. With iPayments from iSolutions, you can enhance the functionality of AR in Business Central to accept payments faster and streamline processes.

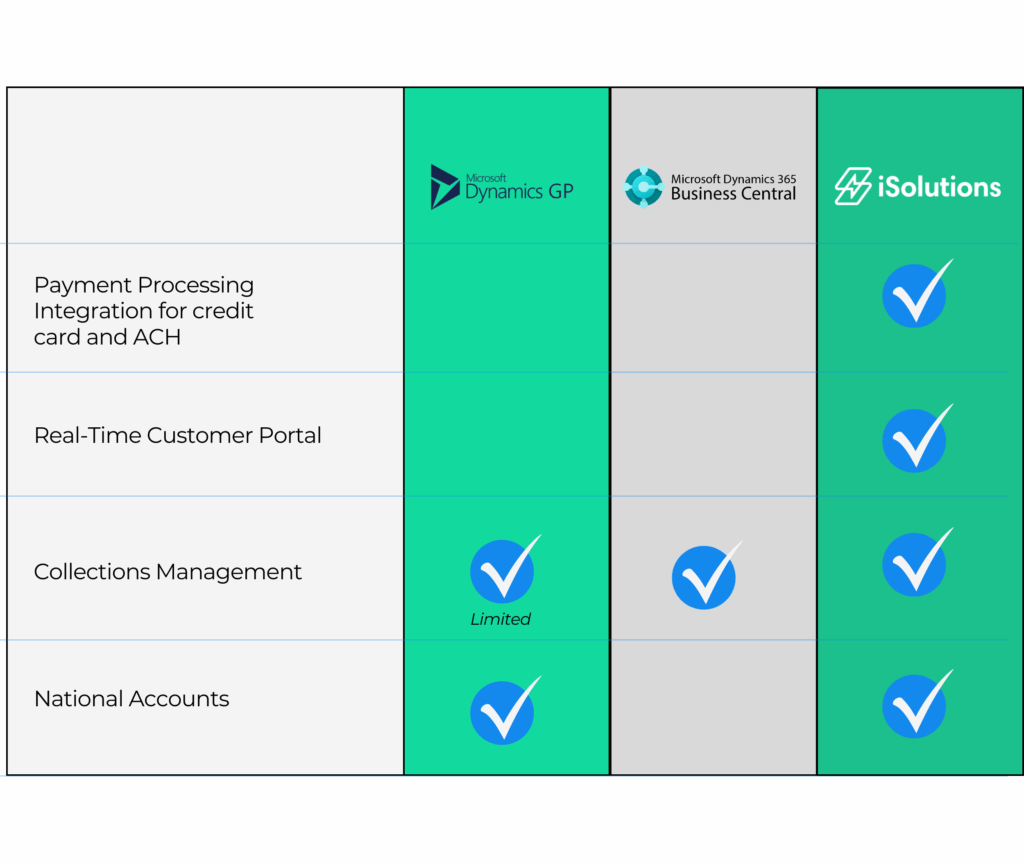

A quick break down of AR within GP, Business Central, and Business Central with iPayments:

- Dynamics GP = Manual-heavy, needs add-ons for automation.

- Dynamics 365 Business Central = Modern AR automation with reminders and dashboards.

- Dynamics 365 Business Central + iPayments = Adds online payments, customer portal, click-to-pay, and real-time posting, drastically improving cash flow and reducing collection cycles.

Best Practices for a Smooth AR Transition

Step One: Find the Right Partner

The most important aspect of transitioning from Dynamics GP to Dynamics 365 Business Central is finding the right partner to guide and support you along the way. We have a list of partners that we recommend on our website.

Step Two: Evaluate your AR Processes and What Business Central Provides

When planning your transition, specifically related to your AR processes, we recommend you first conduct a gap analysis of your current vs future AR workflows. What is working now, what isn’t working, and what do you wish your system would do to help you automate your work?

This is the step in which the majority of companies determine they need an add-on solution for their AR processes – which is where iSolutions comes in to play. You can request a demo of the solution directly from the iSolutions team, or through your partner.

Step Three: Review Your Data

Throughout your implementation project you’ll hear often about the importance of cleaning up your data before importing to Business Central. That is important for AR as well. Ensure you are cleaning and validating customer and transaction data before your implementation.

Step Four: Train Your Team

Train your AR team on new features and processes within Business Central. Let them call out any areas where they don’t feel comfortable or think there is a better process. The more hands on time, training, and feedback that your team is able to take part in, the better success rate. This goes for any members of your team during an ERP implementation.

Step Five: Test Before You Go Live

Test all of your AR scenarios before you go live with Business Central. iSolutions has put together a list of testing tips for successful go-live you can access here.

Start Your Journey to AR Automation with Dynamics 365 Business Central and iPayments

Many organizations have relied on Dynamics GP since the early Great Plains days, and countless professionals have built their entire careers around it. Moving away from a system you know and trust is never easy. However, with Dynamics GP approaching its sunset, planning your transition now is critical. Waiting until the deadline will likely increase costs, as demand for consultants and migration services will surge when everyone rushes to move to Business Central at the last minute.

Reach out to the team at iSolutions to learn more about how you can automate your AR processes within Business Central with iPayments. We’re also available to provide partner recommendations based on our experience in the Microsoft channel.