Most merchants are aware that they need to have credit card payment solutions to conduct business transactions. Credit card transactions come with certain costs through interchange fees. It is the cost imposed on a merchant accepting credit cards at their business.

Interchange fees cover the risks and costs linked with processing payments such as protection from fraud and chargebacks respectively. This fee goes to the banks that issue the cards and not the payment processor.

These fees are both non-negotiable and constant for every merchant. Credit card brands such as Visa and MasterCard determine interchange fees.

Merchants experience constant challenges in getting low costs for processing. A lot of them feel like they do not have a choice in deciding the fees charged on each transaction. this is not exactly true.

Through interchange optimization, merchants can get very good rates for each credit card swipe. They can save a lot of money through a system that allows the processing of credit card payments for the least expensive interchange rates. Explore interchange optimization and what it means for you.

Understanding Interchange Optimization

This is much more than simple credit card processing. It’s a system in which business transactions involving credit card payments are correctly aligned with all the information needed by the card associations so as to qualify for minimal rates.

A lot of the costs that go into accepting credit card payments are carried by the banks that issue credit cards. These costs come in the form of interchange fees. Banks lose money in interest through allowing a cardholder a grace period to repay their debt.

Therefore, banks proceed to charge businesses interchange fees as a sort of reimbursement for the interest lost. To fully understand the process of interchange optimization and the impact it has on merchant processing fees, it’s imperative that you first understand how interchange operates.

How Does Interchange Work

When a business accepts a credit or debit card as payment, the money is not sourced from the buyer’s account immediately. The business does, however, receive a deposit of the funds within one or two days.

The bank that processes the payment will deposit the money into the bank account held by the business. The customer’s bank will proceed to deduct the money from the cardholder’s account. This is done after it has deducted the interchange fee.

However, the transaction between the two banks from both the merchant and the buyer is not equal to the original amount transacted. Remember that the merchant’s bank has still not made any money yet.

They will thus proceed to charge the business the difference between the original amount transacted and the amount deposited into the business account. This move helps them break even and gain a little profit from it.

Essentially, what happens is the bank serving the business will pay the fees to the buyer’s bank first. They will then collect a fee from you that is higher than the interchange fee they paid initially.

So technically, the business does not pay interchange costs. The bank that processes the transaction pays to the customer’s bank then reimburses itself from the business.

How Card Brands Calculate Interchange

There are currently hundreds of interchange cost structures that work in deciding the rate charged. Interchange rates are constant for each merchant processor and are available for public view.

Each transaction done on the card is subjected to a particular category. If the transaction is processed smoothly, the transaction will qualify for the target category. Once qualified, the merchant will be charged the interchange fee associated with the charge rate of the target category.

In the event that something goes wrong and the transaction does not proceed as intended, the transaction will then be downgraded to another category. When this downgrade happens, the rate will be a lot higher thus costing the merchant a lot more money.

Merchants can avoid this downgrade through interchange optimization. This saves many merchants a lot of money through efficient interchange classification. This process ensures that the details processed during a transaction should conform to certain protocols defined by the card brands.

The interchange categories explained above to get to determine the number of interchange fees. Credit card companies usually use a flat rate. The flat rate is accompanied by a certain percentage, usually around 2% of the total amount of sales. This includes taxes.

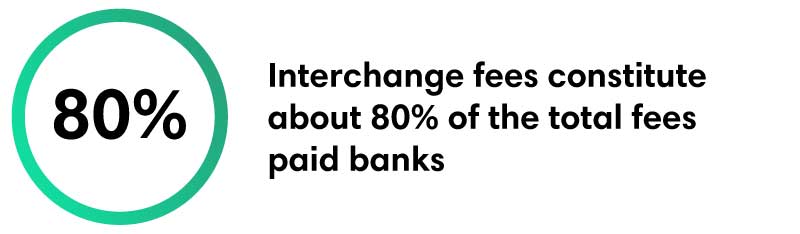

Merchants do pay other fees to banks while making sales using credit and debit cards. However, interchange fees constitute about 80% of the total fee paid to banks. As a result, merchants pay billions of dollars in interchange fees every year.

You Can Take Advantage of Interchange Optimization

While it’s certain that interchange costs cannot be negotiated, there are strategies for lowering how much a business pays these fees. A business can adjust its payment transactions to qualify for different interchange categories through interchange optimization.

Most of the expenses accrued from credit card payment processes in business are made up of interchange fees. This makes it even more important to make sure that most of the transactions qualify for the lowest possible categories as many times as possible.

The same way transactions intended for a particular interchange category to reflect high interchange costs, so can a transaction be adjusted to suit different categories. A strategy of this nature does nothing to negotiate lower rates.

Instead, it adjusts the transaction to qualify for a category that will impact lower fees on the business. This process involves optimizing data to meet the criteria for a better interchange category. It also involves fixing initial downgrades meaning the business is not charged for unnecessary and costly fines.

As a business owner, you want your transactions to fall under your designated target interchange. The target interchange is where you’ll fall if you have done nothing for the bank to find you with a downgrade. It also means that you have not done anything to optimize your basic requirements for you to get improved data interchange.

However, the basic target interchange is the best rate a business can possibly get for a transaction. But some transactions can get lower-cost fees if you added information is provided with the transaction. This applies to government cards, purchasing cards, and corporate credit cards as well.

The category in which a transaction falls under depends on certain factors. Some of them can be controlled and optimized, but not all.

These factors include:

The Method of Transaction

Point of Sale (POS) credit card transactions is not as risky as CNP (Card not present) transactions. This is because a PIN is not required, and neither is a signature or a chip to be scanned.

The safe nature of swiping cards helps keep interchange fees low. Online orders and MOTO orders (Mail Orders and Telephone Orders) are classified as CNP transactions thus command a higher interchange rate.

The Type and Brand of Card

There are separate interchange categories for both credit and debit card charges. Debit cards with PINs tend to be less expensive as compared to credit cards because they carry lower risk. Each credit card company can thus charge a different rate.

Rewards cards charge higher rates because of the perks allowed to card owners. This may, however, entice the card owner to make more purchases.

The brand of a card will also have an effect on interchange qualification. Visa, for example, has different rates as compared to MasterCard. Businesses, however, are not at liberty of choosing what brand of card their customers use.

Nature of Industry

Interchange rates depend on the type of business involved. Merchant Category Code (MCCs) designations exist depending on the type of business and industry. For instance, fueling stations pay a lot less than supermarkets.

The Size of Business

Individual, corporate and government credit cards have different interchange categories. Bigger businesses tend to pay less money in fees because they have enough financial muscle to hold negotiations with banks or credit card companies.

Keep in mind that although interchange fees are constant for every merchant, they are not static. Depending on the time value of money as per current interest rates and the cost of moving money, credit card companies regularly change their rates.

Take Visa and MasterCard for instance. These two usually change their interchange rates two times every year around April and October.

Interchange Optimization is Crucial for Big Business

Interchange fees are a part of a business in the modern world that any business cannot afford to neglect. If credit and debit cards make up the most of your transaction traffic, make sure that you are well optimized for enhanced data. Doing otherwise will mean that you are going to pay for more than you should be.

Downward categories, on the other hand, will cost you more than the target interchange categories. you will be charged more for not meeting certain data requirements. A business will receive a downgrade even if one requirement is missing.

Contact us today so we can help you with interchange optimizations solutions for your business.