Credit Card Processing Levels: When you process a credit card, you’re then placed into one of three processing categories: Level 1, Level 2, and Level 3.

Level 1 has the highest rates and Level 3 has the lowest. As you move up levels, there are more line-item details that must be sent with each transaction.

What Is Level 1 Processing?

Level 1 credit card processing: Refers to business-to-consumer (B2C) transactions, during which consumers use their personal credit cards to make purchases both large and small. The data required for a Level 1 transaction to go through is small, with just the merchant name, transaction amount and date needed.

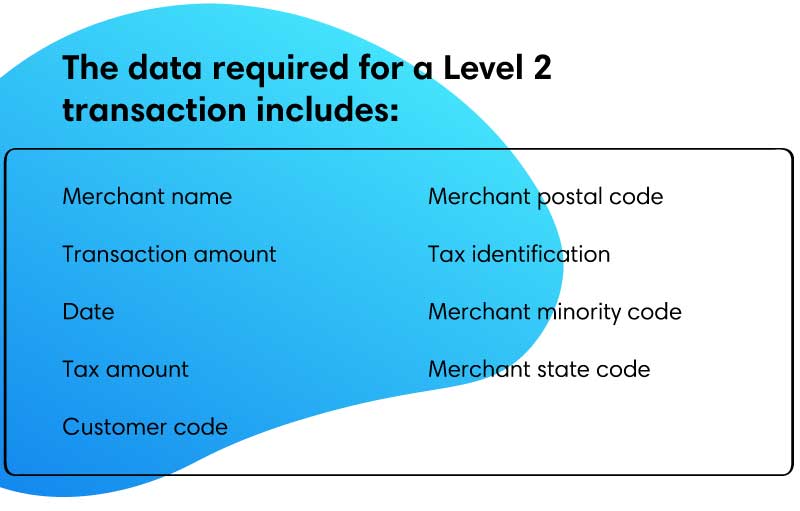

What Is Level 2 Processing?

Level 2 credit card processing: Refers to a more detailed transaction designed to support business-to-business (B2B) payment processing. For business or government transactions will require business-specific payment methods. This includes the ability to monitor and control corporate and employee spending. Level 2 credit card processing simplifies the B2B transaction, improving customer service for your business clients and provides them with more accurate transaction reports.

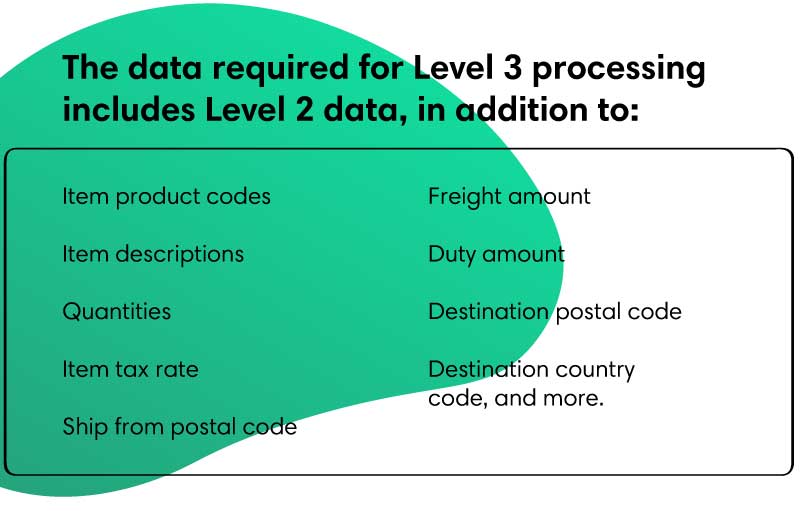

What is Level 3 Processing?

Level 3 credit card processing: Requires the most detailed data, and the transactions are often made with government or corporate purchasing cards. Government agencies and businesses use purchasing cards for enhanced reporting and more control over employee purchases. The data fields required for Level 3 processing includes those from Level 2 transactions, in addition to several others.

What are the Benefits of Level 2 and Level 3 Credit Card Processing?

B2B credit card processing solutions such as Level 2 processing can help B2B merchants build strong relationships with their clients, as well as increase large ticket transactions with corporations and government agencies.

Credit Card Processing Levels: As listed above, each level of processing has specific requirements needed for verification and authorization. These requirements will range from very limited (level 1) to very detailed. Part of what defines this will be the type of customers or clients your business serves.

Why is this important? Because the more data fields required, the lower the processing rates.

Any transaction that is submitted with Level 2 and Level 3 card data will qualify for lower Visa and MasterCard Interchange rates.

Many government and institutional cardholders, like those paying with GSA SmartPay, are starting to require vendors to submit Level 3 Card Data.

Commercial cards are eligible for level 2 and 3 rates but may be charged at level 1 rates if all data isn’t provided. Consumer cards are only eligible for data level 1.

Sending Level 2 or Level 3 Data with a Transaction.

Credit Card Processing Levels: When sending level 2 or level 3 data with a transaction, it’s important to provide complete info in order to qualify for the best pricing. Note: Some processing companies can help set you up in a way that streamlines the process when providing the above lists of required data. For example, some virtual terminals can auto-fill information making the process of sending enhanced data a lot faster. This also helps with training time, since your staff won’t need to be shown how input all of the data.

Since enhanced data is sent at the time of the transaction, you’ll need to use equipment that supports level 2 or 3 data.

Your transactions will qualify for enhanced data categories if you meet the requirements.

For a commercial card, you’ll be paying more than you have to if your transactions don’t qualify for level 2 and 3 rates, or if you downgrade by failing to meet the minimum requirements, such as using address verification or settling the transaction in the specified timeframe.

Downgrades will show on your billing statement with labels like: “standard,” “std,” or “EIRF.”

Benefits of Level 2 and 3 B2B Transactions.

For the business taking the card, processing transactions by including level 2 and level 3 data will result in lower costs than level 1 data, meaning a lower overall cost of processing for your business. Visa’s interchange table even notes in some places that B2B payments receive better pricing, as shown in this screenshot:

B2B Transaction Costs

For the business using the card, level 2 and level 3 data provide greater details on the transactions conducted by employees, allowing for more effective budget/spending management and reporting. Additional benefits from the card brands may also apply, such as rental car insurance, emergency cash advances, roadside assistance, corporate trip planning, global medical assistance, lost passport/luggage reimbursement, and more. These benefits will vary by card company and may have additional requirements.

Is it possible to not accept commercial cards?

No. Your agreement with the card brands generally includes a provision requiring that you accept all types of cards that are valid for payment.

Am I required to send enhanced data?

No, however when processing business or purchasing cards, it’s in your best interest. When you accept a commercial card, it remains a commercial card even when you do not send the enhanced data with the transaction. However, without enhanced data, the transaction will downgrade. Any time a transaction downgrades, you’re paying more for processing that transaction.

If you only take commercial cards now and then, you may be able to set up credit card surcharges for those transactions to help defray the costs of a downgrade, but surcharging is often disliked by customers and should be considered carefully. If you take commercial cards regularly, qualifying for enhanced data is a better long-term solution.

Level 2 and 3 Rates:

Here are some cost comparisons when you accept commercial cards if they qualify for the preferred interchange categories.

The example below was taken from the Visa interchange table for corporate and purchasing cards, referred to as commercial in Visa’s interchange categories.

Interchange Category Interchange Rate

Commercial Level III 1.90% + $0.10

Commercial Level II 2.50% + $0.10

Commercial Card Present 2.50% + $0.10

Commercial Card Not Present 2.70% + $0.10

Commercial Standard Interchange Reimbursement Fee 2.95% + $0.10

The rate applied to a transaction that qualifies for Commercial Level 3 is 1.90% + $0.10. The rate for a Commercial Level 2 transaction is 2.50% + $0.10.

On the other hand, the Commercial Card Not Present category will cost you 2.70% + $0.10. That means that if you accept a commercial credit card and don’t provide level 2 or 3 data, you’ll pay .20% – .80% more.

The Commercial Standard Interchange Reimbursement Fee category is the lowest downgrade category, with the most expensive rate of 2.95% + $0.10. If you accept a commercial credit card, don’t provide level 2 or 3 data, and also fail to pass minimum requirements, your transactions will downgrade to this category, leaving you to pay a full 1.05% more than you could have paid with the Level 3 category.

As shown above, it is important to try to process using Level 2 or Level 3 and provide the required data in order to have lower processing fees.