Ask a finance leader if they trust their AR data and most will say yes. Dig a little deeper, and the answer changes.

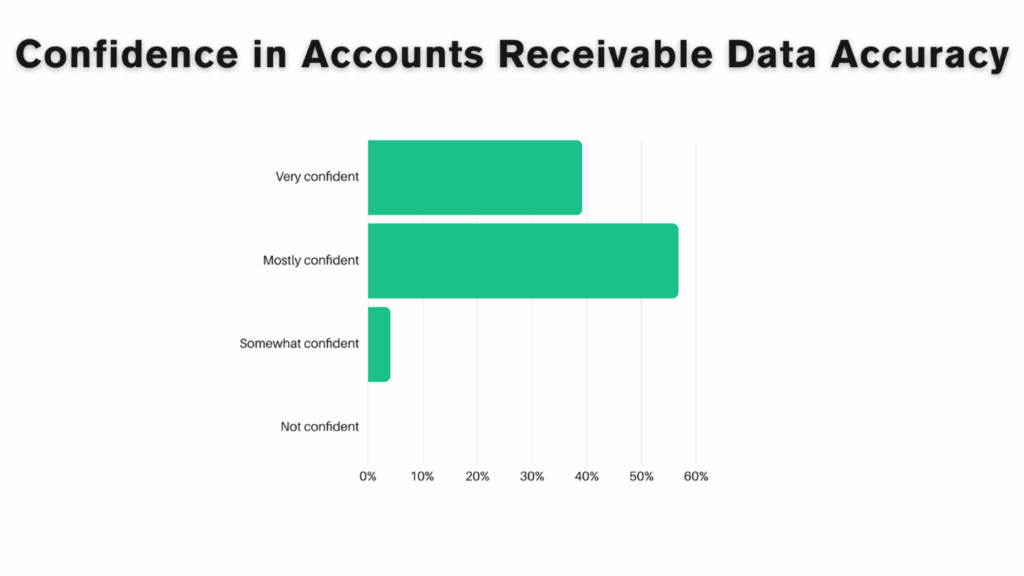

In our 2026 AR research, most respondents reported being “very” or “mostly” confident in their AR data. At first glance, that sounds reassuring.

But in today’s environment, “mostly accurate” isn’t good enough.

When AR data is delayed by manual posting, trapped in disconnected systems, or reconciled after the fact, confidence erodes quietly. Forecasts become estimates. Cash planning gets conservative. Growth decisions slow down, not because leaders are cautious, but because the numbers aren’t airtight.

And the irony? Many of these organizations have already invested in some automation. They’re sending invoices electronically. They may even be accepting digital payments. But without end-to-end integration and real-time visibility, automation stops short of delivering trust.

This gap shows up in real ways:

- Leadership hesitates to rely on AR aging

- Cash forecasts need “buffers”

- Collections teams react instead of prioritize

The most forward-thinking finance teams are changing that narrative. They’re treating AR data not as a back-office output, but as a strategic asset that needs to be timely, accurate, and visible across the organization.

If you want to learn

- Why partial automation creates data risk

- The connection between confidence and cash forecasting

- What “real” AR visibility actually looks like in practice

download the full State of AR in 2026 report.

If you’ve ever paused before answering the question, “How confident are we in our AR numbers?” – this research is for you.