Offering robust functionality and an easy-to-use interface, Dynamics 365 Business Central is the leading ERP solution for small to mid-sized businesses. Developed by Microsoft, and hosted in the cloud, Business Central is an end-to-end solution for financial and operations management for any business.

With functionality spanning from financial management to sales and service, supply chain, project management, and more – you would think that Business Central has all of the capabilities needed for any business out of the box. However, there are many gaps in the system, or functionality needed by specific industries or organizations. That’s where Independent Software Vendors (ISVs) come into play. ISVs develop solutions to fill the gaps in Business Central and list those applications on Microsoft AppSource.

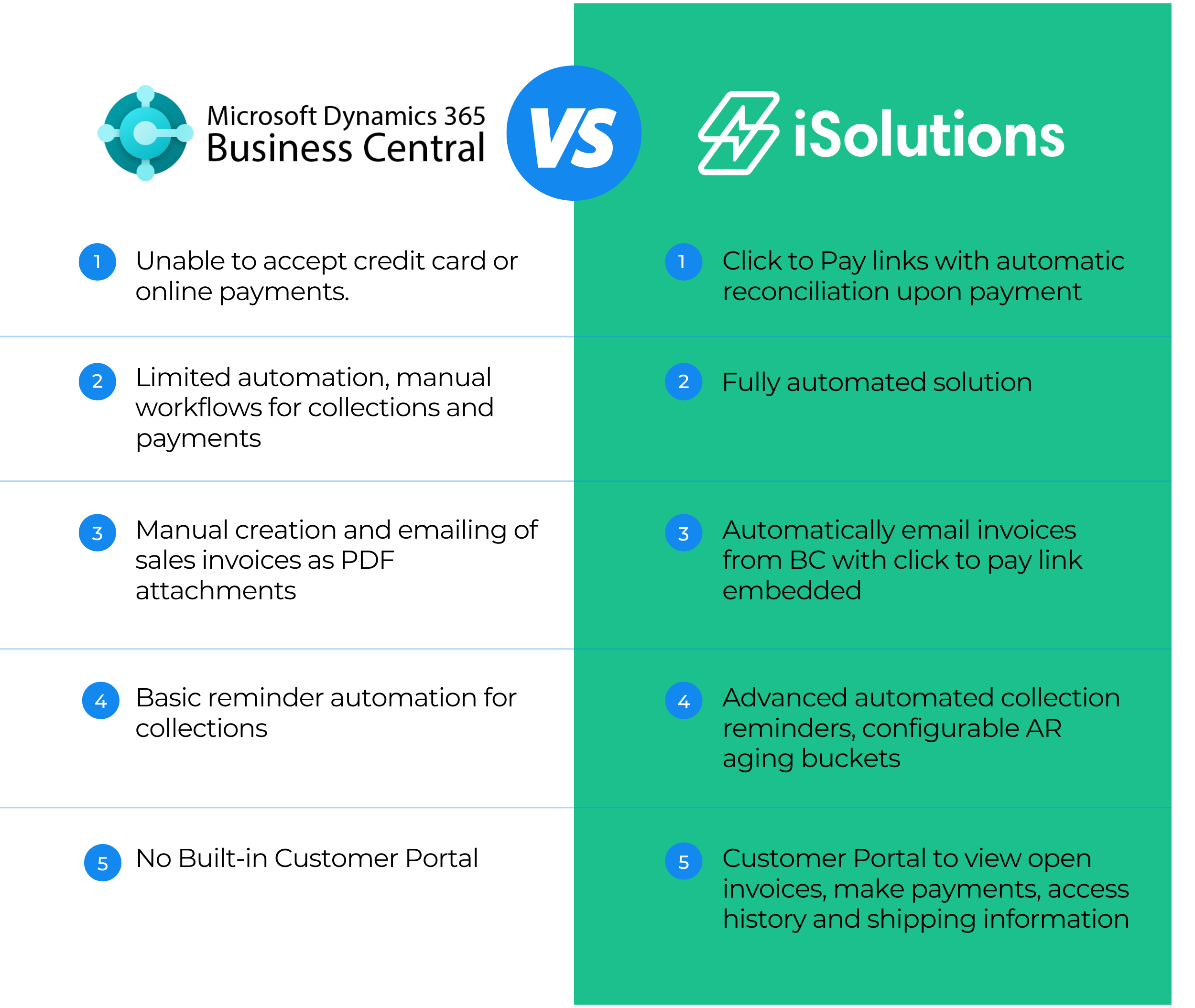

A key area of Dynamics 365 Business Central with functionality gaps is Accounts Receivable. Lets outline what is included out of the box, and how iPayments from iSolutions enhances the functionality to automate payments, collections, and more.

Accounts Receivable, Payments and Collections in Business Central

Within Dynamics 365 Business Central, there is powerful functionality for financial management and accounts receivable. Users can generate invoices directly from sales orders and send those out to your customers to coincide with the sale or with shipment. After the invoice is applied, the AR team steps in to ensure that payment is made and applied to the account.

Accepting Payments with Business Central |

|

|---|---|

| Manual Payment Entry |

Record payments received via check, bank transfer, or cash. Apply them to open invoices manually or automatically. |

| Bank Reconciliation |

Import bank statements and match payments to open entries. Use the Payment Reconciliation Journal to apply and post payments. |

If you’re looking to Business Central to accept online payments, you need to incorporate an add-on solution like iPayments. With Business Central, customers are unable to pay invoices online out of the box. In fact, Business Central lacks payment links, customer portals, and real-time updates. If you’re looking for an invoice payment option for Business Central, iPayments is a key solution.

Credit Card and ACH Processing with iPayments |

|

|---|---|

| Credit Card and ACH Processing |

Authorize, capture, and reverse transactions directly within Business Central Sales Orders, Invoices and Service Documents.

|

| Click to Pay |

Customers receive a secure link embedded into an invoice for easy payment. Additionally, you can send a link to your customers from collections that allows them to pay multiple outstanding invoices.

|

| Credit Card Reconciliation |

Upon receipt of credit card payment, invoices and account information within Business Central are automatically updated to reflect payment.

|

| Funding |

When CardPointe makes a deposit to your bank, iPayments funding job will automatically record a debit to the bank and a credit to the clearing account.

|

| API Integration |

Connect with our APIs to integrate payments from any application into Business Central.

|

| Qualify for Lowest Rates |

Reduce credit card processing rates by sending additional transaction details from Microsoft Dynamics 365 Business Central documents.

|

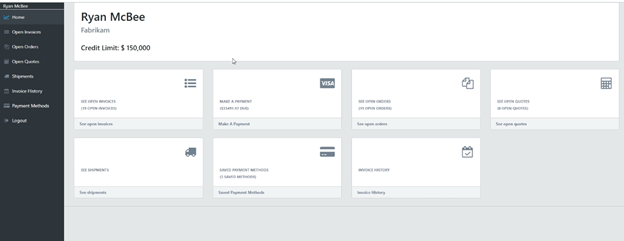

For those businesses that want to provide a self-service portal for your customers, iPayments includes that in the advanced package. The customer portal allows individuals to log in and view their account history, orders, open invoices, and make payments. The data is real-time directly from Business Central through a secure connection.

Customer Portal with iPayments |

|

|---|---|

| Pay and View Invoices |

Give customers the ability to view and pay their invoices on their own time. Customers can pay one invoice or multi-select to pay multiple simultaneously.

|

| History |

Empower your customers with the ability to view and search their account including invoice history and amount paid.

|

| Partial Payments and Credit Memos |

Allow user to edit amount to pay on sales document or apply open credit memos to sales documents.

|

| Personalized User Access |

Invite specific customer contacts from your BC environment to access their portal. Toggle on or off to display Quotes, Orders, or Shipments based on user type.

|

| Automated Email |

Use templates to send automated emails providing portal access, allowing users to reset their passwords, and to provide authorization codes.

|

| Save Payment Methods |

Customers can securely store credit card and ACH payment methods for faster payment processing.

|

The portal is completely customizable to your brand so you can add your logo, specific colors, and other brand elements to give your customers a familiar feel.

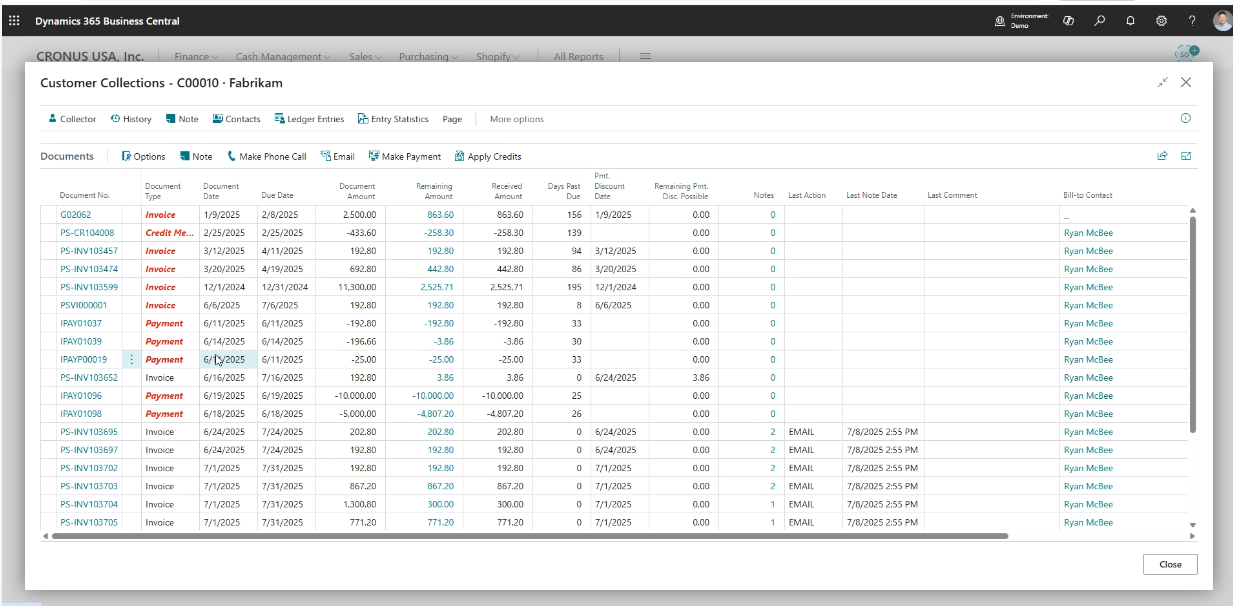

Functionality in Dynamics 365 Business Central for Collections Management

Collections and Outstanding Balances in Business Central |

|

|---|---|

| Send Customer Statement Report |

From each customer card, you can create a statement. Then you generate a PDF and send it to the customer.

|

| Payment Reminders |

Set up reminder terms to define rules, fees, and interest calculations, then generate reminders either in bulk or individually. Once finalized, issue the reminders to post entries to the customer and general ledgers, and track them on the issued reminders page.

|

| Add finance charges for overdue amounts |

Create Finance Charge Memos action creates finance charge memos for all or selected customers with overdue balances.

|

| Collect payments with SEPA Direct Debit |

Collect payments directly from the customer’s bank account according to the SEPA format.

|

| Block Vendors or Put them on Hold |

You can block vendors so that people can’t select the vendor on purchase documents or post payments to the vendor

|

While Business Central has native collections features, there are limitations due to manual follow ups and processes that strain AR and finance teams and slow down cash flow. There are key benefits of automating accounts receivable follow up, which is why most companies running Business Central opt for an ERP collections automation solution like iPayments.

Advanced Collections Management with iPayments |

|

|---|---|

| Automated Email |

Automatically email invoices upon posting, when a credit memo is posted, and include note no. series.

|

| Configurable AR Aging Buckets |

Age by due date, posting date, or document date. Define quantity and length of periods. This setting produces your collection manager aged accounts receivable.

|

| Automated Actions |

Promise to pay marked complete when invoice is paid, note records added when emails are sent from collections management, email template used when escalating record to alternate collector, and more.

|

| Automated Collections Plans and Reminders |

Send customers automated reminders for past due invoices with click to pay links. Option to include attachments and select from a variety of templates including collector and delinquent alerts. Automated plan sequence for balance due, delinquency notices, or collections which halts automatically upon payment received. Can include reminders and past due . Ability to have different plan types for different customers. Reminders can be tailored to your preferences – including reminders when a payment due date is approaching or when a payment is past due. Open invoices can be sent individually or combined into one reminder email.

|

| Assign/Transfer Collectors |

Assign or transfer collectors automatically or manually

|

| Record Account Engagement |

Create notes on communication with customers such as calls or emails.

|

| Promise to Pay Settings |

When a customer promises to pay, you can create a note on the customer record to track the promise and monitor delinquency. Easily view past due reminders and stay on top of overdue accounts.

|

Functionality in Dynamics 365 Business Central to Apply Payments and Reconcile Bank Accounts

Apply Payments and Reconcile Bank Accounts in Business Central |

|

|---|---|

| Import and Apply Payments |

Import bank statements to automatically apply payments to open customer or vendor ledger entries, then reconcile the bank account once all payments are applied.

|

| Manually Match and Apply Payments |

Review detailed match data and suggested open entries to manually apply payments when needed.

|

| Resolve Unmatched Payments |

Handle payments that can’t be automatically applied—such as those with amount discrepancies or missing ledger entries.

|

| Set Default Posting Accounts |

Link payment text to specific customer, vendor, or general ledger accounts to ensure recurring cash receipts or expenses are posted correctly when no matching documents exist.

|

| Define Auto-Application Rules |

Configure rules for how payments and bank transactions should be automatically matched to open ledger entries using the Apply Automatically function in the Payment Reconciliation Journal.

|

| Reconcile Customer Payments from a List of Unpaid Sales Documents |

After customers make electronic payments to your bank account, you must apply each payment to the corresponding sales document and post it to update the customer, general ledger, and bank ledger entries.

|

| Reconcile Customer Payments with a Cash Receipt Journal or from Customer Ledger |

When receiving a cash payment or issuing a refund, you can apply the amount—either fully or partially—to open customer ledger entries to close them and keep customer statistics, account statements, and finance charges up to date.

|

| Consolidate Balances for a Company that is a Customer and a Vendor |

When a customer is also a vendor, you can consolidate their balances by linking the companies manually.

|

While Business Central can apply payments, there is a manual process for every step. To streamline these processes, iPayments has enhanced the system by adding:

Enhanced Payment Application and Reconciliation with iPayments |

|

|---|---|

| Real Time Payment Posting |

Customer payments automatically posted and applied based on settings within the system. As soon as a payment is captured, it is posted in real-time to Business Central with no waiting to import a bank statement.

|

| Automated Matching of Payments |

Post and applied payment captured in real-time. Each cash receipt captured is posted automatically. Use apply-to posting descriptions, the GL entry automatically includes the customer number.

|

| Resolve Unmatched Payments |

Handle payments that can’t be automatically applied—such as those with amount discrepancies or missing ledger entries.

|

| Posted Transactions |

Posted transactions from credit card payments are automatically applied to the clearing account. Funding makes entry to a bank for the amount that was deposited from credit card processing. The bank is debited and clearing is credited.

|

Limitations of Out-of-the-Box AR in Business Central

While there is no doubt that Dynamics 365 Business Central is the best ERP choice for today’s businesses, there are limitations to the native AR capabilities.

- No ability to accept online or credit card payments.

- Limited automation, requiring manual workflows for collections and payment processing.

- Prepayments on sales orders create separate invoices and lock the order, preventing changes.

-

- iPayments allows you to take authorizations for deposits on a sales order, leaving the order open so you can continue to make changes, add lines, change quantities, add freight, etc.

- iPayments provides the ability to take multiple deposits on a single open order without using prepayment functionality.

- No built-in option to authorize payments from quotes or automatically convert them to orders.

- iPayments will automatically convert a quote to an order when payment is verified.

- Changes to orders after authorization aren’t reflected unless manually adjusted.

- iSolutions allows you to capture the amount shipped and automatically reflect that information on the invoice.

- No native Point of Sale (POS) capabilities for handling cash drawers, card readers, or reconciling daily balances.

- With iSolutions Point of Sale functionality, hand held devices are used for card present transactions, and cash drawer management is available to keep track of cash, check, cards, and returns that occur.

Would your business benefit from AR automation software like iPayments? Here are some key indicators:

- High volume invoicing – Are you sending hundreds or thousands of invoices a month?

- Recurring payments – Do you have subscription based models or service contracts?

- Customer facing business – do you want to offer online payment portals or credit card options?

- Lean finance teams – Are you looking to reduce manual AR tasks and improve cash flow?

- Project based businesses – do you need to manage milestone billing or split payments/deposits?

- Issues with past due invoices – do you consistently have customers with past due invoices that you need to chase down for payment?

Key Metrics that Indicate You Need iSolutions

- Monthly Invoice Volume: Typically 500+ invoices/month is a strong indicator.

- Payment Methods: If customers frequently request credit card or ACH payments.

- Days Sales Outstanding (DSO): If DSO is high, automation can help reduce it.

- Manual Effort: If AR processes involve manual reminders, reconciliation, or follow-ups, it’s time to automate.

- Frequent Payment Delays: If you have a high percentage of overdue invoices you can benefit from automation.

- High Error Rate in Invoicing: Are you experiencing errors due to manual data entry?

- Rapid Business Growth: As revenue and customer count grows, manual processes become unsustainable. Having the right foundation in place helps make rapid growth easier.

- Multi-Entity Operations

If you’re in the process of implementing Business Central, or if you’re already live, getting started with iPayments from iSolutions is easy. Reach out to us and we’ll show you how simple the system is to use and get you started accepted payments and automating your processes.

See all of the functionality included in Business Central out of the box here.